Back

Finance

Alfa Bank. Online Banking for Business Customers

Site

Product design

Back

Finance

Site

Product design

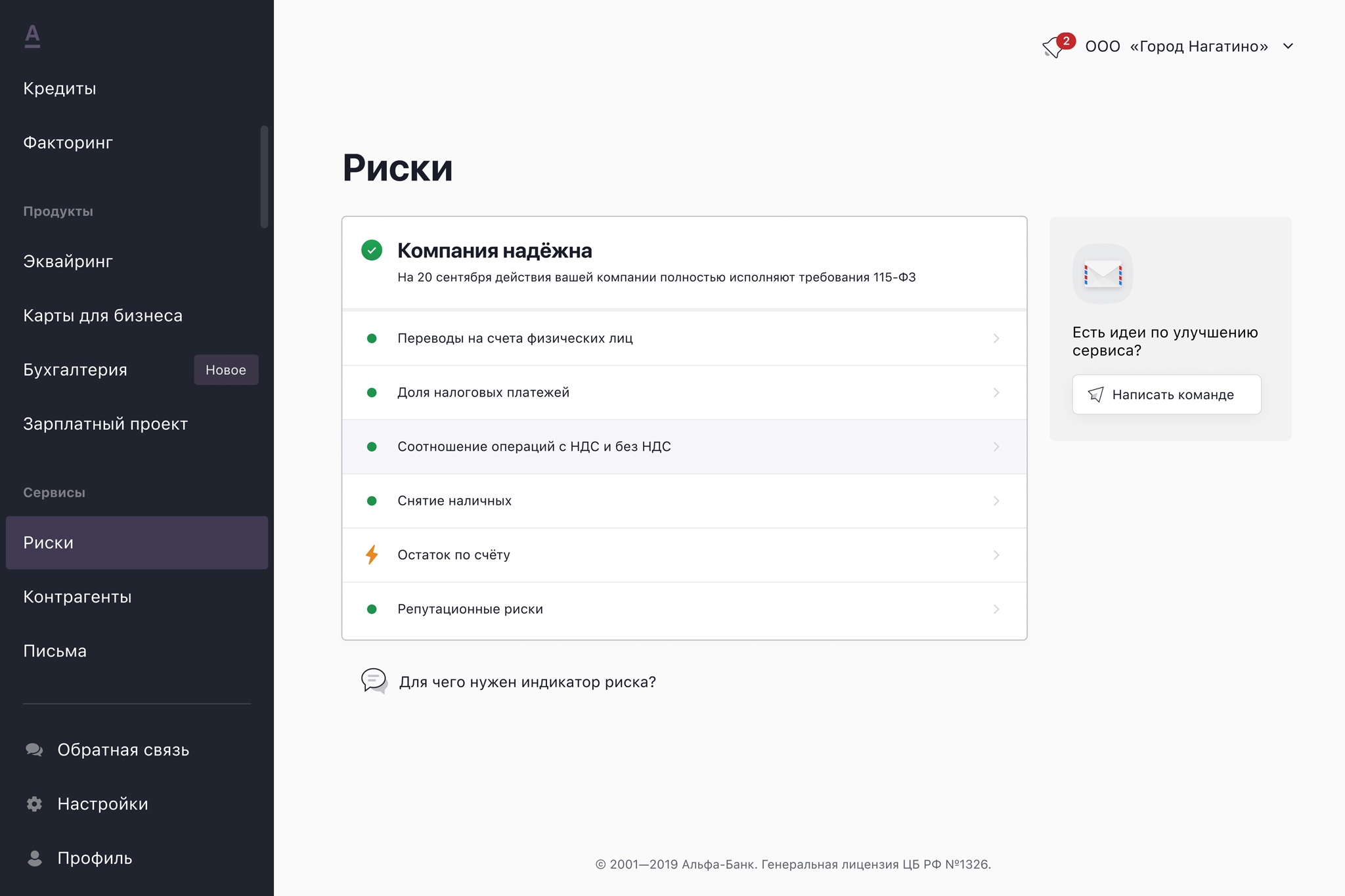

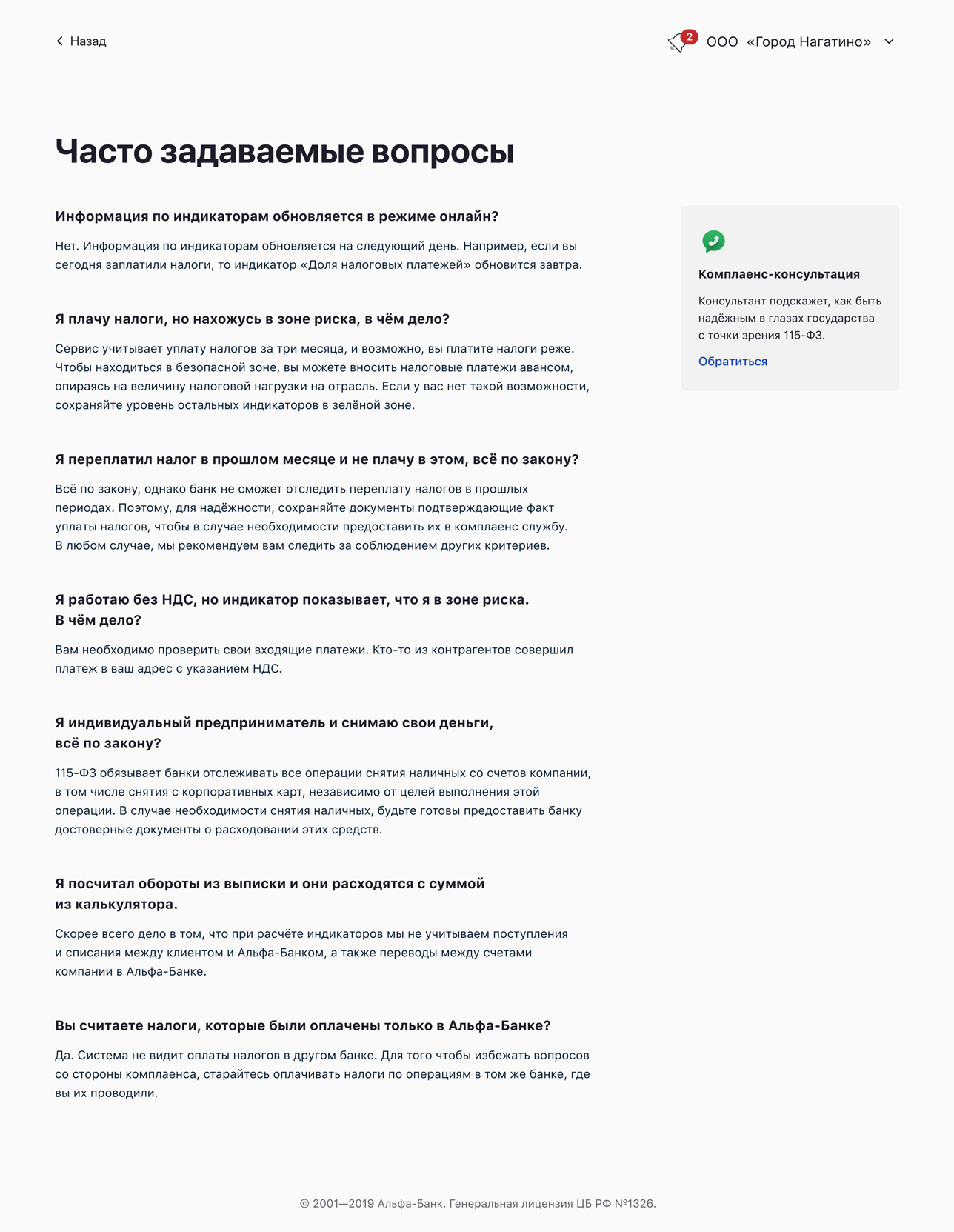

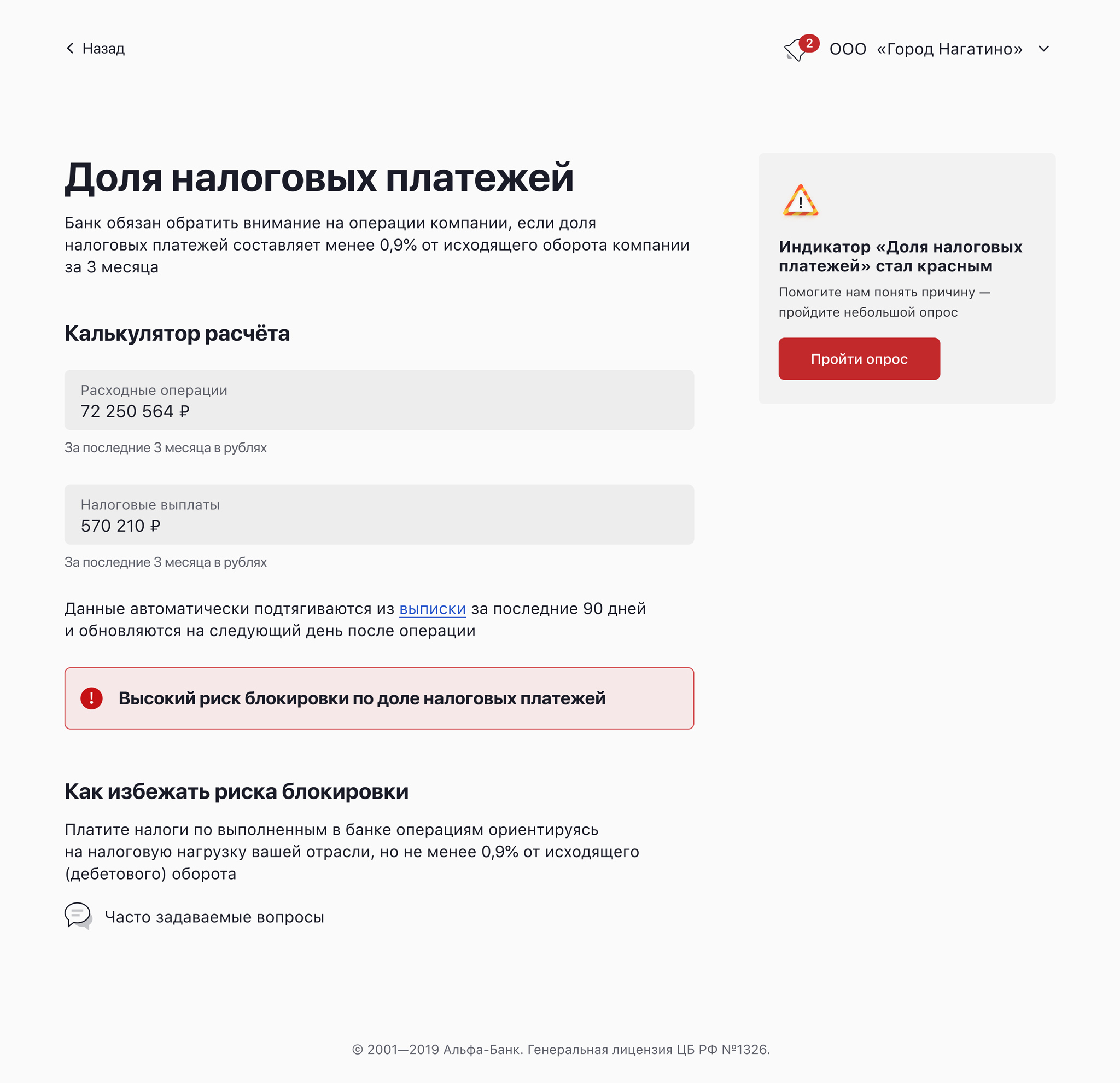

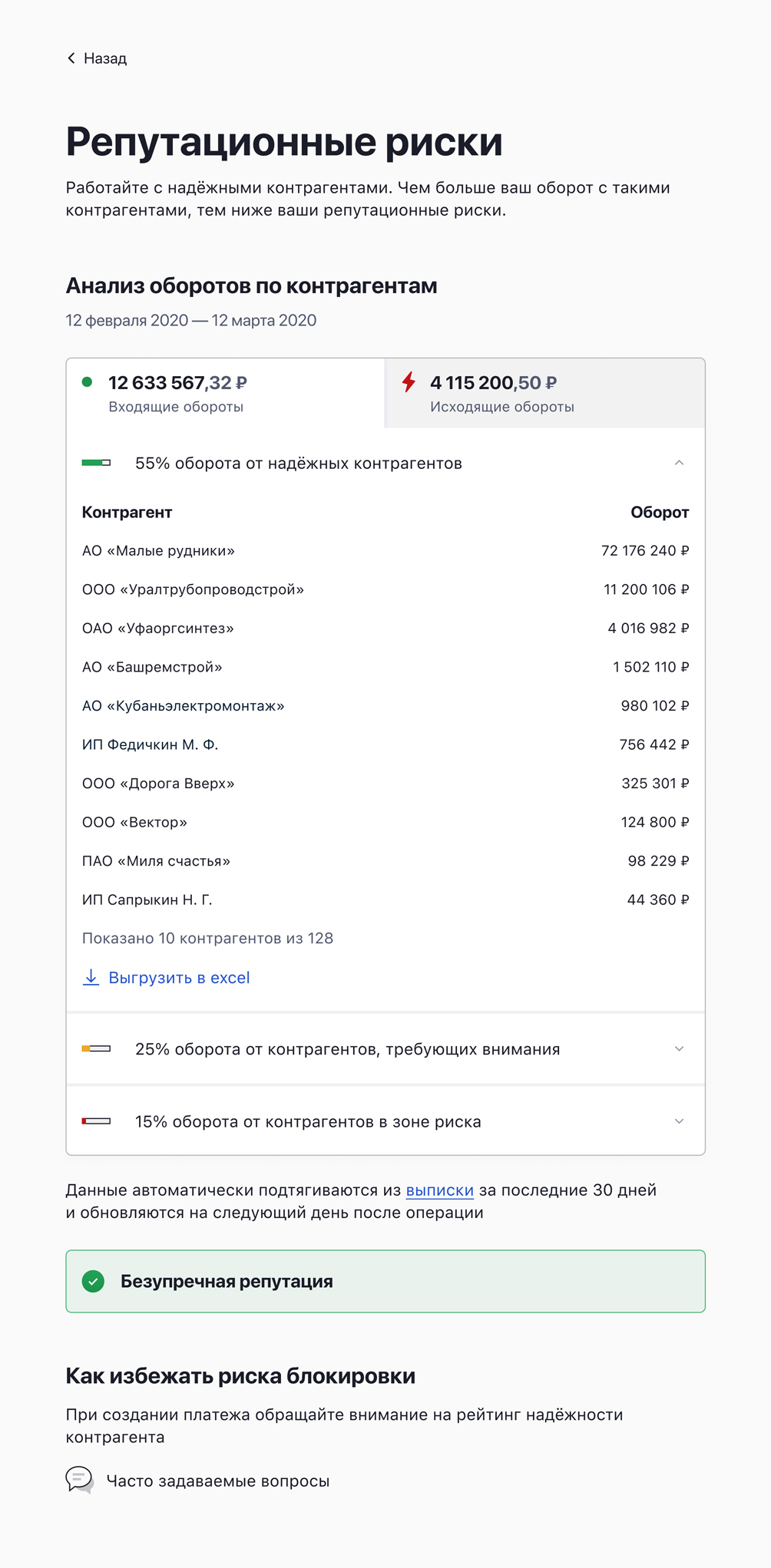

In Russia, Law 115-FZ mandates that banks block their clients’ access to their accounts if suspicious transactions are detected. This law aims to combat shell companies, money laundering schemes, and tax evasion.

However, honest clients may be blocked due to a lack of knowledge or inexperience with this law. For example, withdrawing a large amount of cash and paying a contractor without a formal document might appear suspicious and trigger a block. Such actions, though legitimate, can be misinterpreted as part of a money laundering scheme. Blocking an honest client represents both a financial and reputational loss for a bank. This has created a need for a service that helps clients avoid unnecessary account blocks and conduct their transactions smoothly.

The government wants all organizations to pay their taxes and fees, requiring banks to block suspicious or dishonest clients.

On the other hand, banks aim to keep their customers for as long as possible but don’t want to risk losing their licenses for not complying with Law 115-FZ.

First, we thoroughly studied Law 115-FZ and the automatic algorithm used by our compliance service to understand how the law and the bank identify suspicious customers.

Next, we analyzed blocking data to identify patterns. We found that since the introduction of Law 115-FZ, 82% of clients flagged as high risk were categorized within the first six months of their activity, and 35% of these clients were subsequently blocked. Most of these clients were small businesses with up to 10 employees, whose founder was an online bank user.

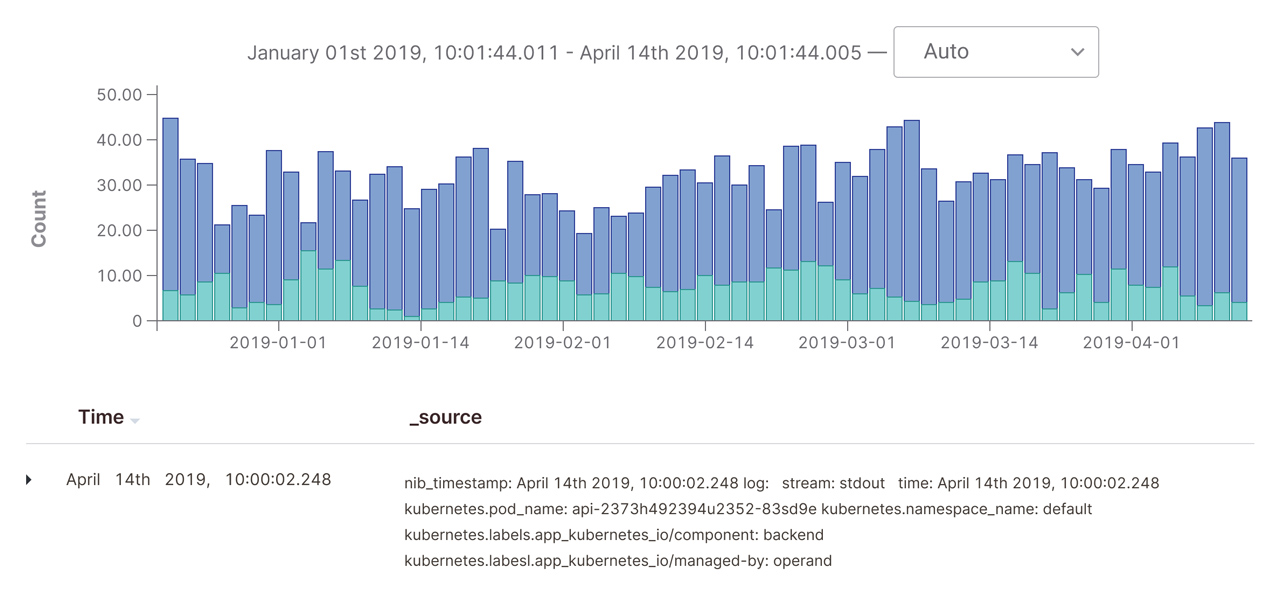

This chart presents the number of customers from the danger zone (green columns) by month.

From this data, we established our initial success metric. We aimed to reduce the number of high-risk clients by a factor of five, as compliance teams reported that only one in five flagged clients had a genuine suspicion warranting manual review. While we could not precisely determine how much the number of blocked clients should decrease from the risk zone if only dishonest clients are flagged, we estimated that there should be a threefold reduction.

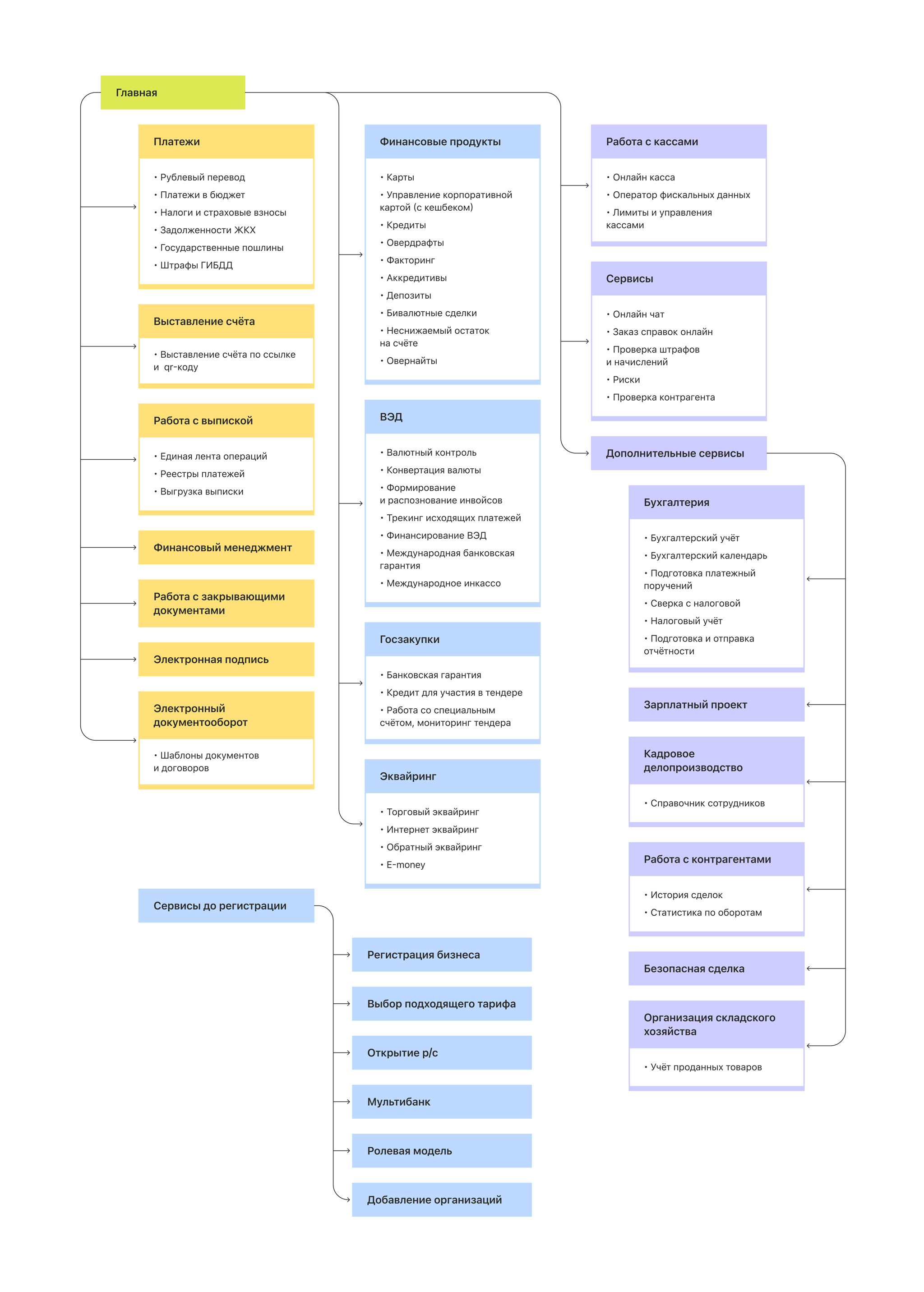

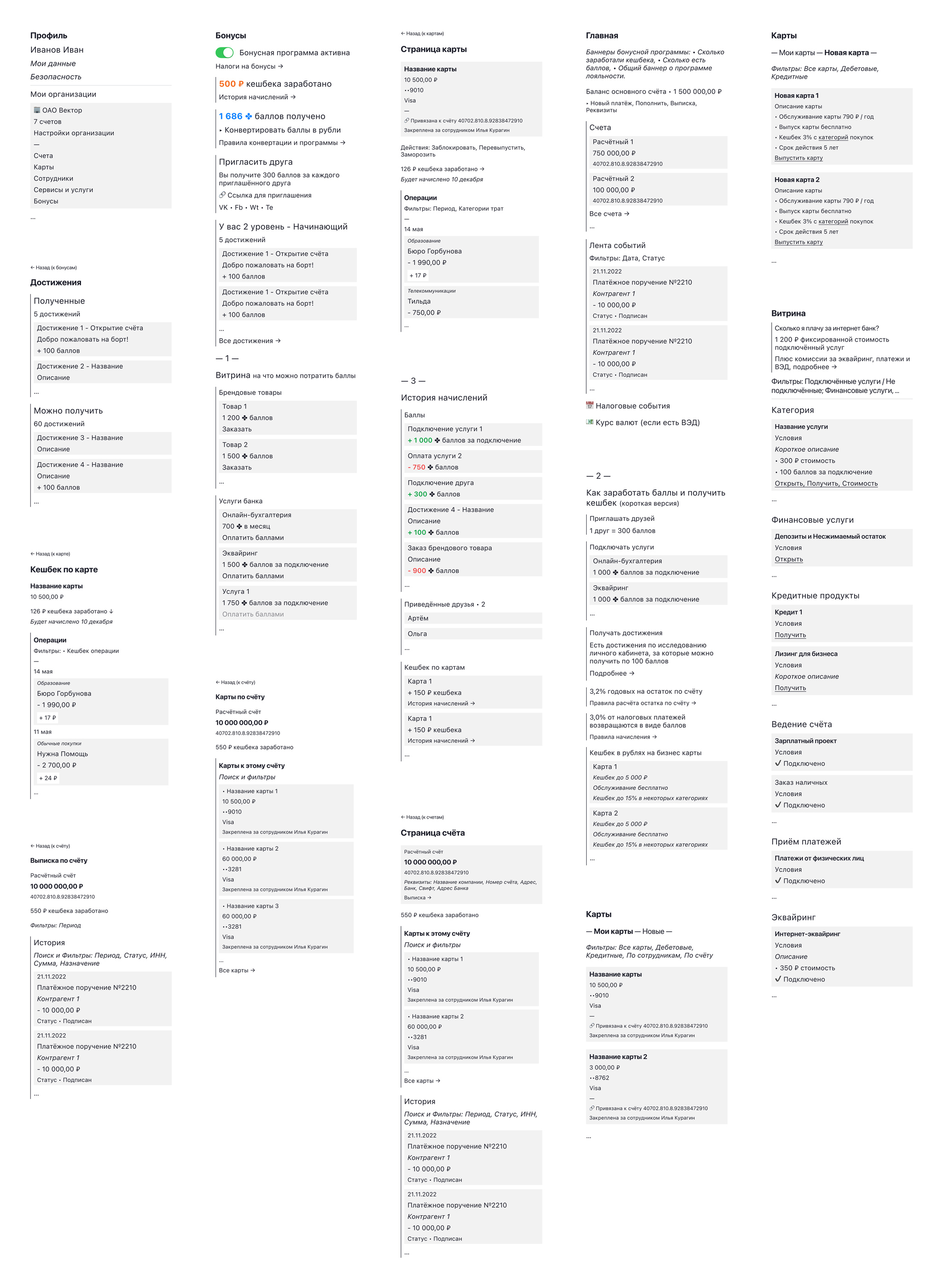

We created an online banking map for businesses to understand how to interact with clients regarding Law 115-FZ. We also reviewed other similar services. At the time of my design work, only Modulbank, with its "Honest Business" initiative, had a comparable service.

A map of services within our online bank. It helped determine the best way to implement the new feature.

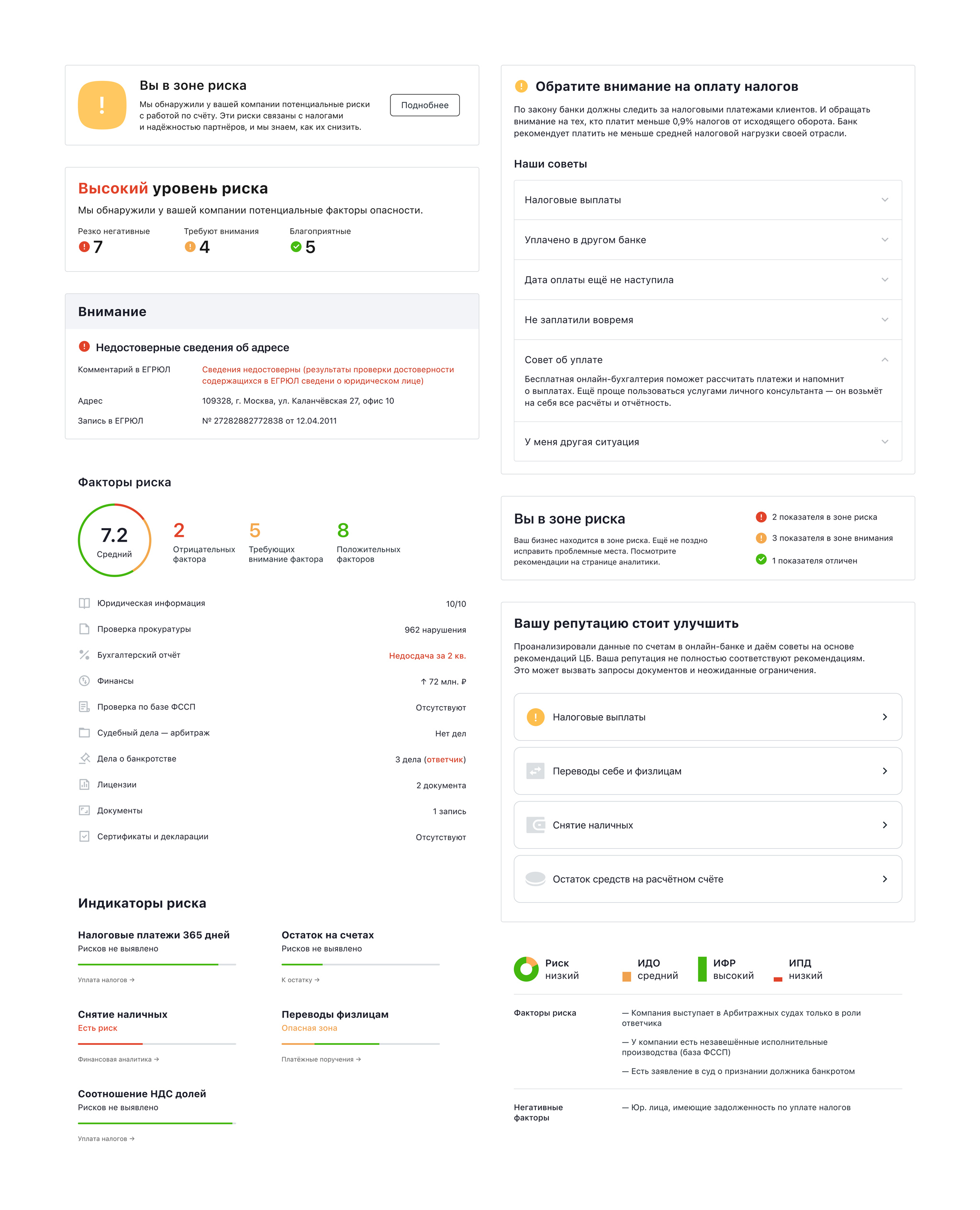

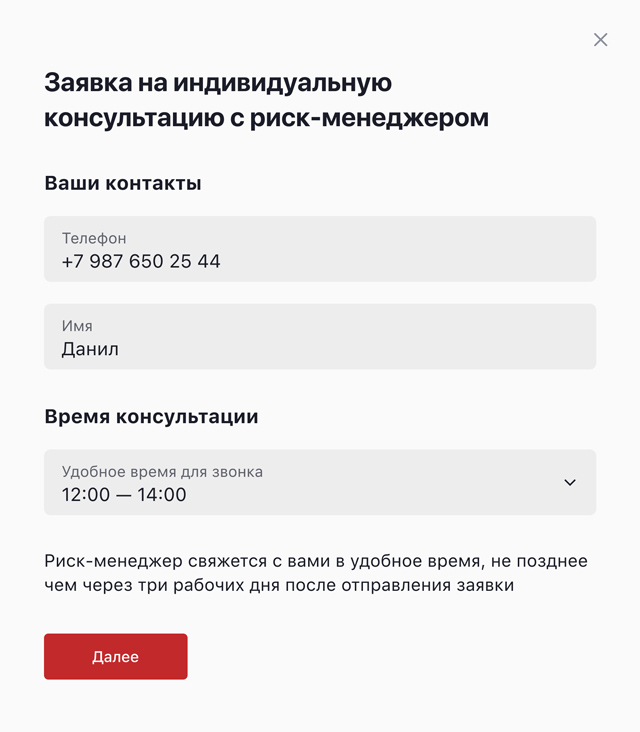

I made some initial assumptions about what the ideal service should be: it should educate the customer, warn them of potentially risky transactions, provide information about their risk level, alert them if something is going wrong, and allow them to quickly prove their integrity by submitting necessary documents or answering questions.

The first hypotheses were developed to address the following questions: Does the client understand their risk level? Does the client recognize when they are initiating a potentially risky payment? Does the client know the minimum tax required to remain in the safe zone? Does the client know how to respond to the bank if suspicion arises?

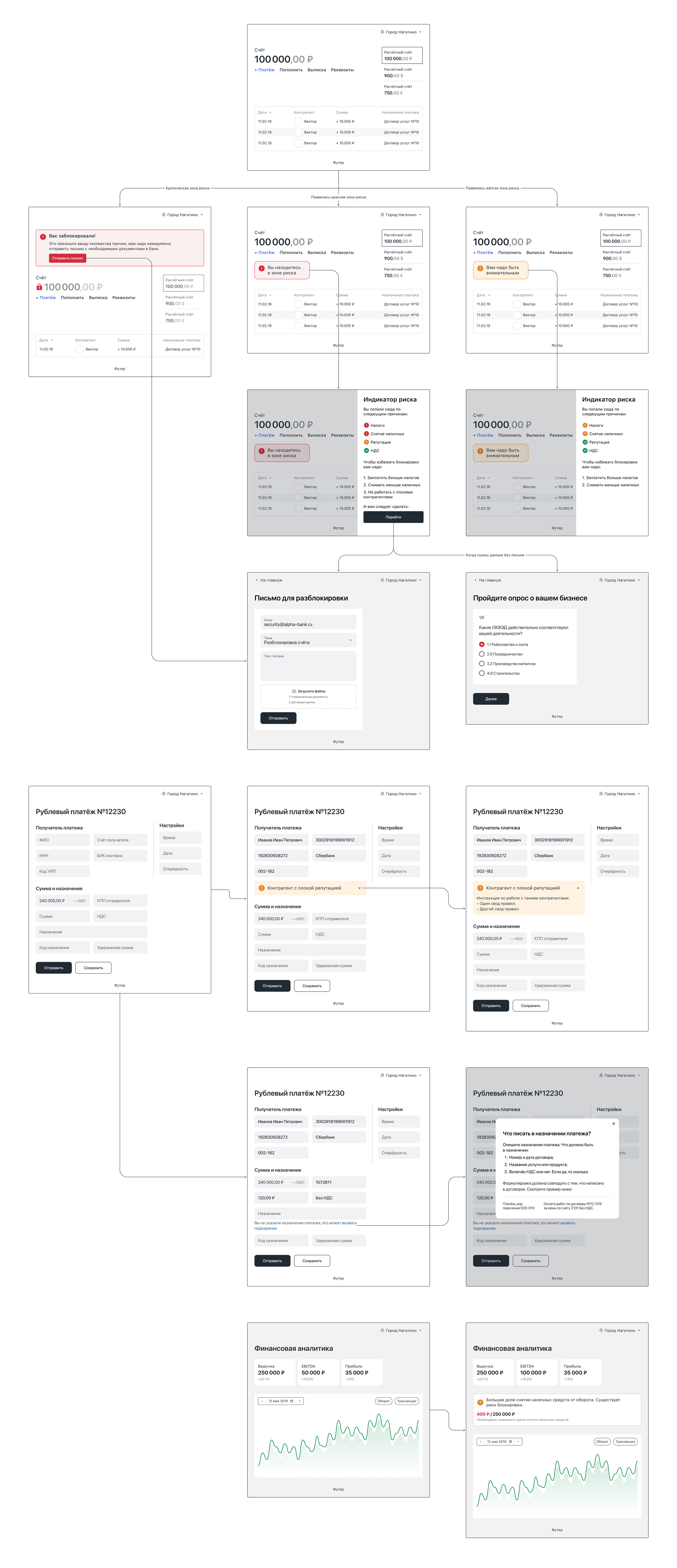

First sketches of the future service.

Requirements for research session participants were established. I sought small business owners and representatives from larger companies, where the primary online bank user is an accountant or financial director. Although large businesses are only blocked 2% of the time when in the risk zone, they are still valuable to the bank due to their higher turnover and the greater financial impact of their losses.

Some of the widgets from the first layouts.

The process was divided into two stages: first, the researcher presented a prototype, and after usability testing, she asked questions about 115-FL according to a plan we developed together. One key insight from the testing was that users recognized the risk of being blocked but wanted a clearer understanding of how this risk was calculated rather than just seeing recommendations for mitigation. Similar feedback was given regarding the widgets on the payments page. Users saw a warning about high withdrawal rates and questioned, "What specific value did I withdraw?"

Okay, I understand that the situation isn’t ideal, but I don’t see the numbers behind these calculations. How am I supposed to make decisions based on this information?

— One of the respondents

Based on this feedback, we decided to refine the solution by showing detailed calculations and the rules used for those calculations. Instead of the banner on the main page linking to a general information page, it now leads to a dedicated indicator page with more comprehensive information. This change proved successful—hits in the red zone decreased by a factor of eight, and the percentage of blocks from the red zone dropped from 35% to 4%. The bank executives were pleased with the service, which they began promoting as a competitive advantage. The bank’s vice president even shared it on Facebook.

Surveys were introduced to identify the reasons why a client might be at risk. Additionally, a list of counterparties with their ratings was added to help determine which ones are reliable to work with.

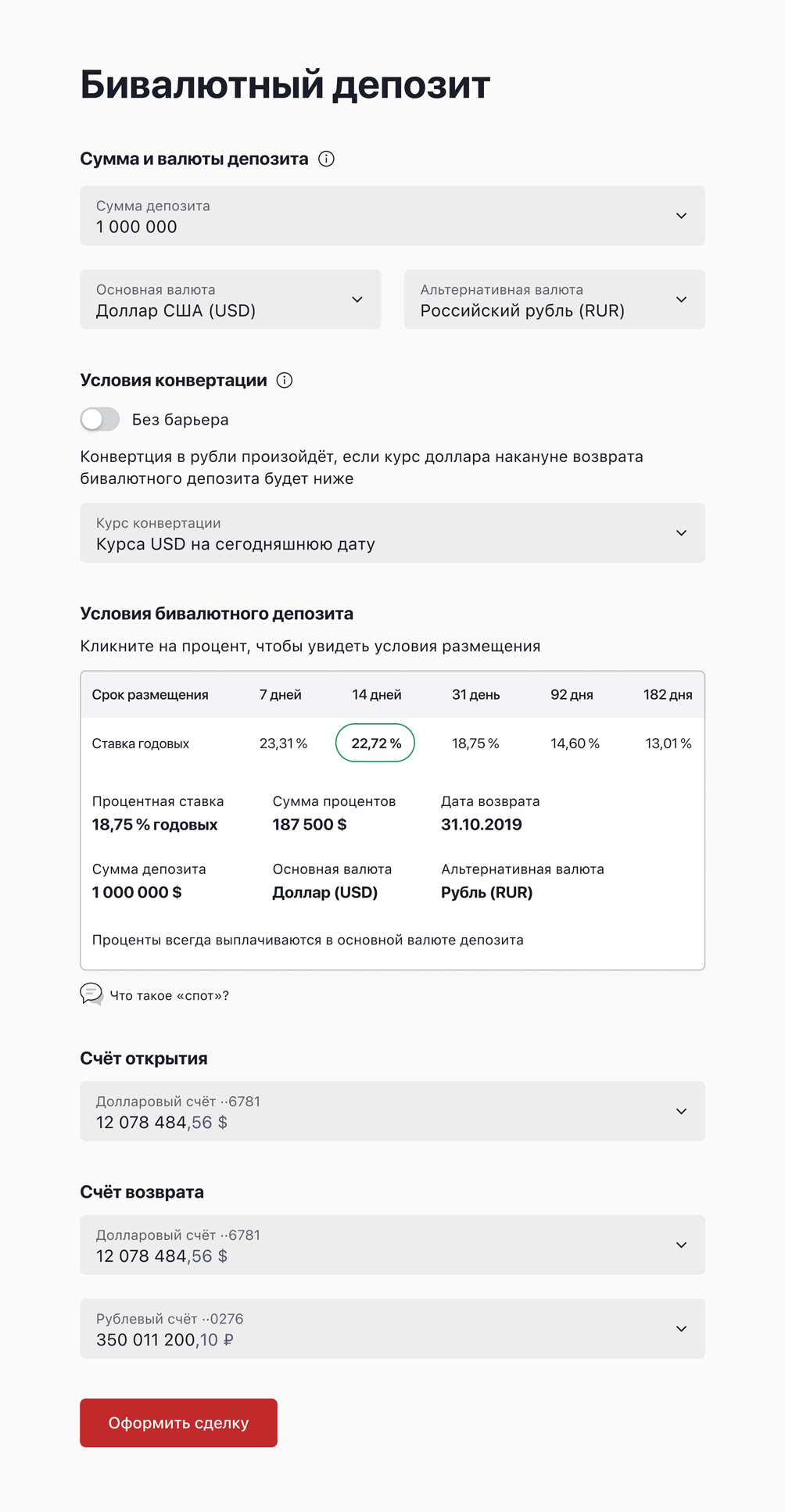

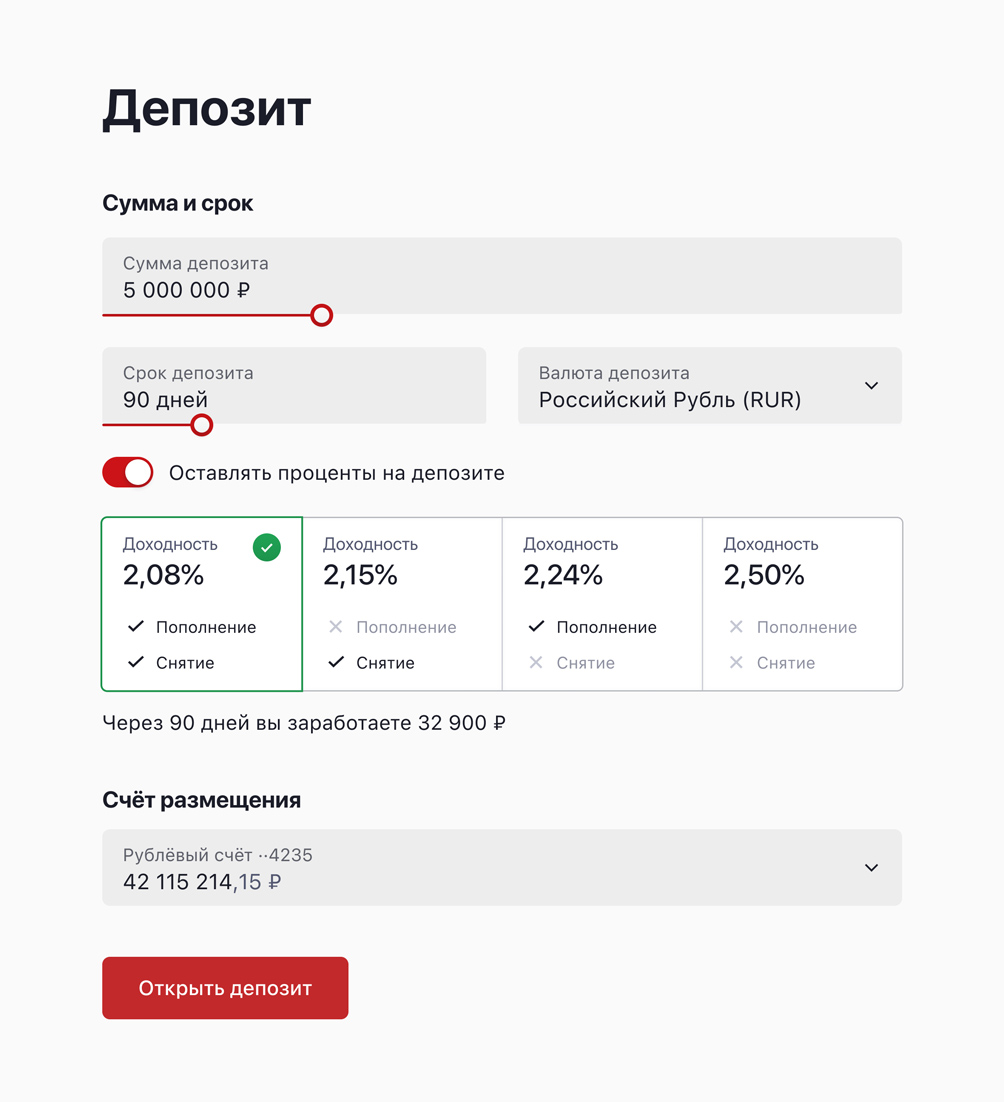

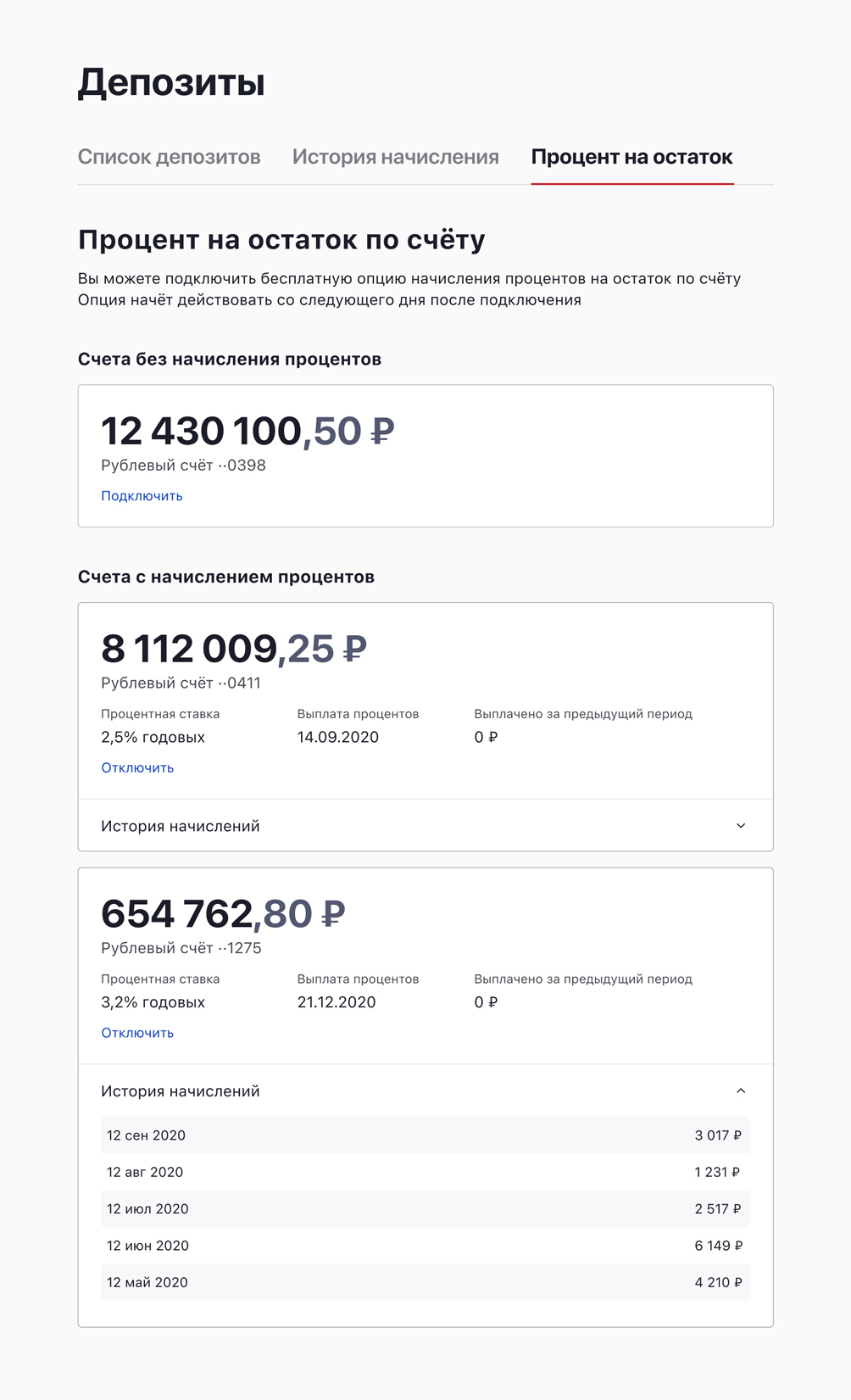

The service aims to provide clients with a convenient tool for managing their idle funds. Among various options for placing funds, the dual-currency deposit stands out as the most interesting. It offers a higher rate than a standard deposit and allows conversion to another currency at a predetermined rate.

Income from this deposit comes in two parts: the standard interest rate for the deposit and additional income from an option premium. This service is particularly advantageous for clients with a predictable payment schedule who know the desired exchange rate for buying or selling currency, as they can set the rate and date for the currency conversion.

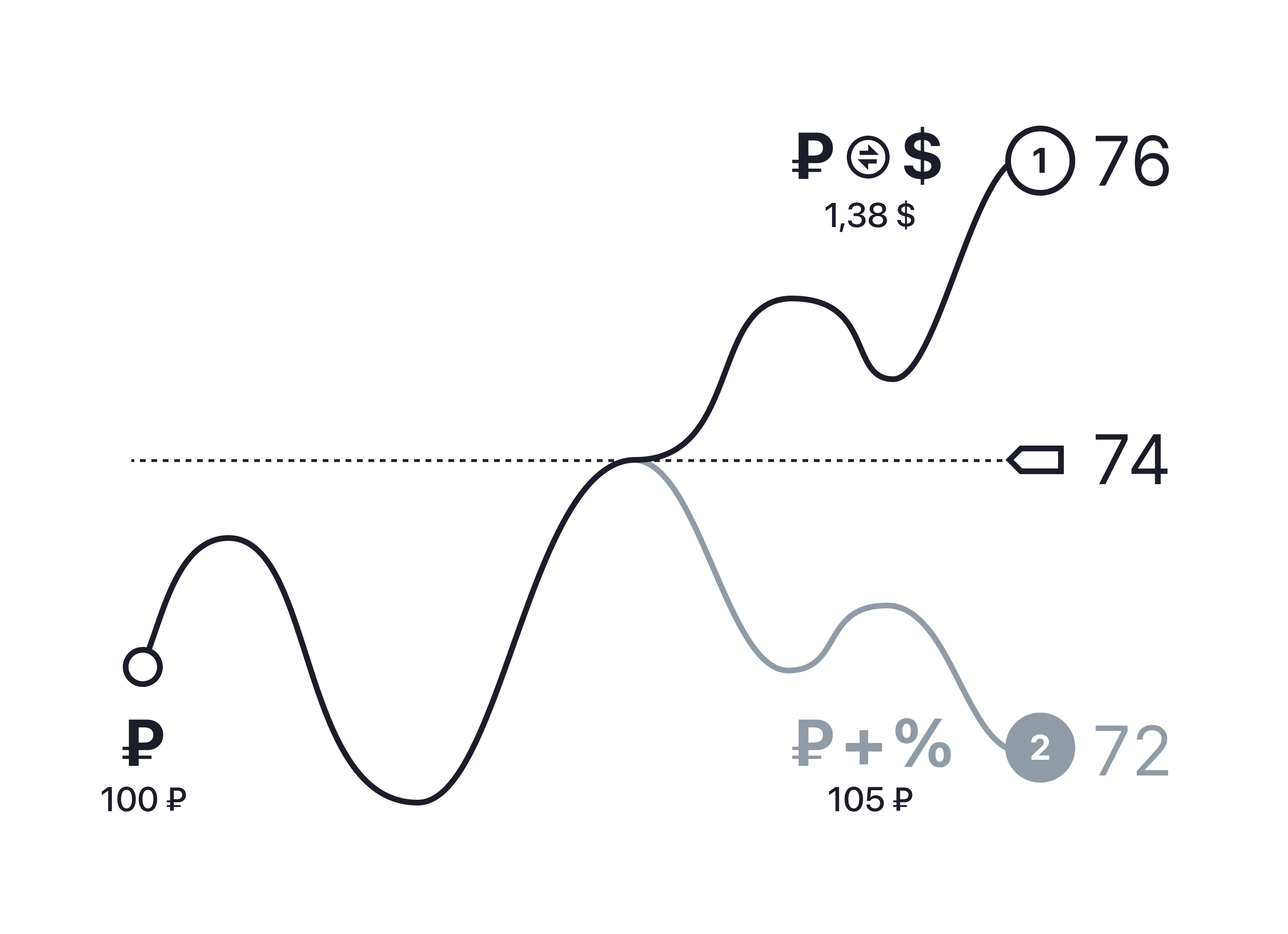

Dual-currency deposit work scheme.

For example, if you invest 100 ₽ in a dual-currency deposit with a ruble/dollar pair, the conversion rate is set above 74. If the dollar appreciates, the deposit is converted into rubles, and the client profits by selling the currency, receiving $1.38. If the dollar depreciates, no conversion occurs, but the client benefits from an increased interest rate and receives 105 ₽. The risk lies in the possibility that the exchange rate fluctuations and conversion probability might not yield a return greater than the deposit rate.

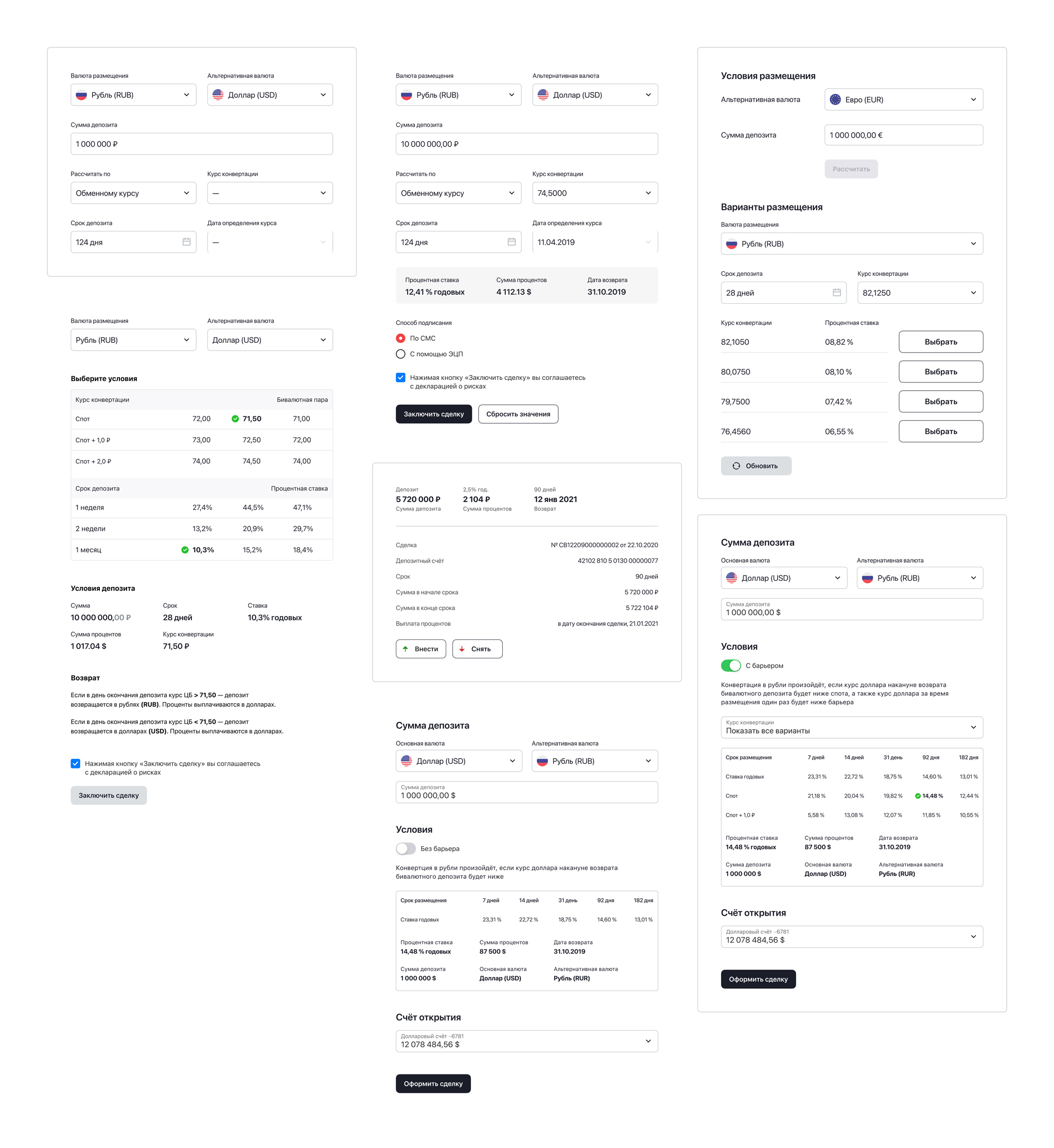

Although the product is complex, it is financially attractive for the bank. Therefore, different options needed to be tested to ensure the final solution was as straightforward as possible.

Some of the first layouts.

The tests revealed that the linear form version performed better than the other options. During the tests, clients clearly articulated their actions while filling out the form fields, indicating they understood what they were doing. In contrast, the version with a table and input grid lacked this clarity.

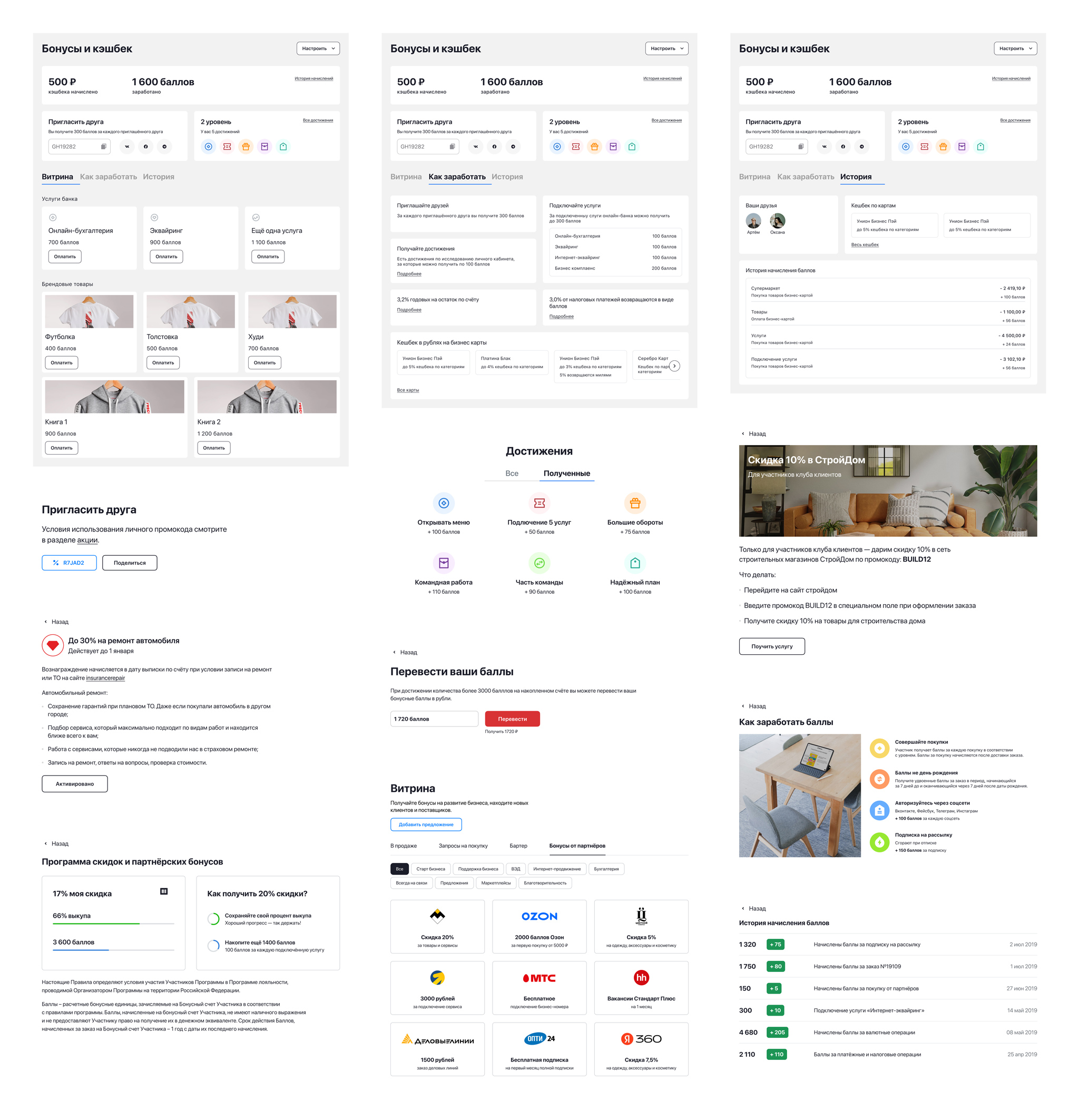

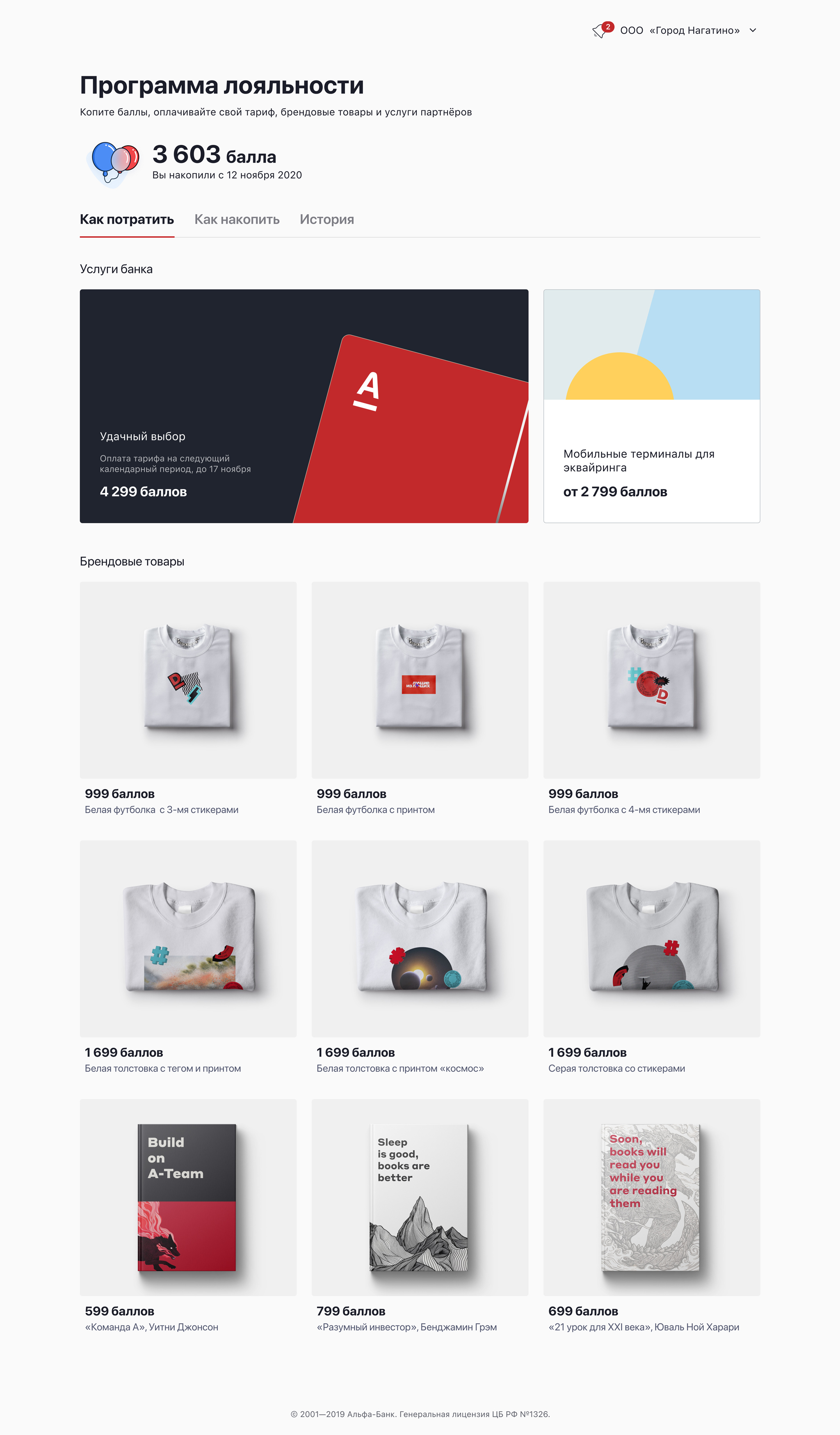

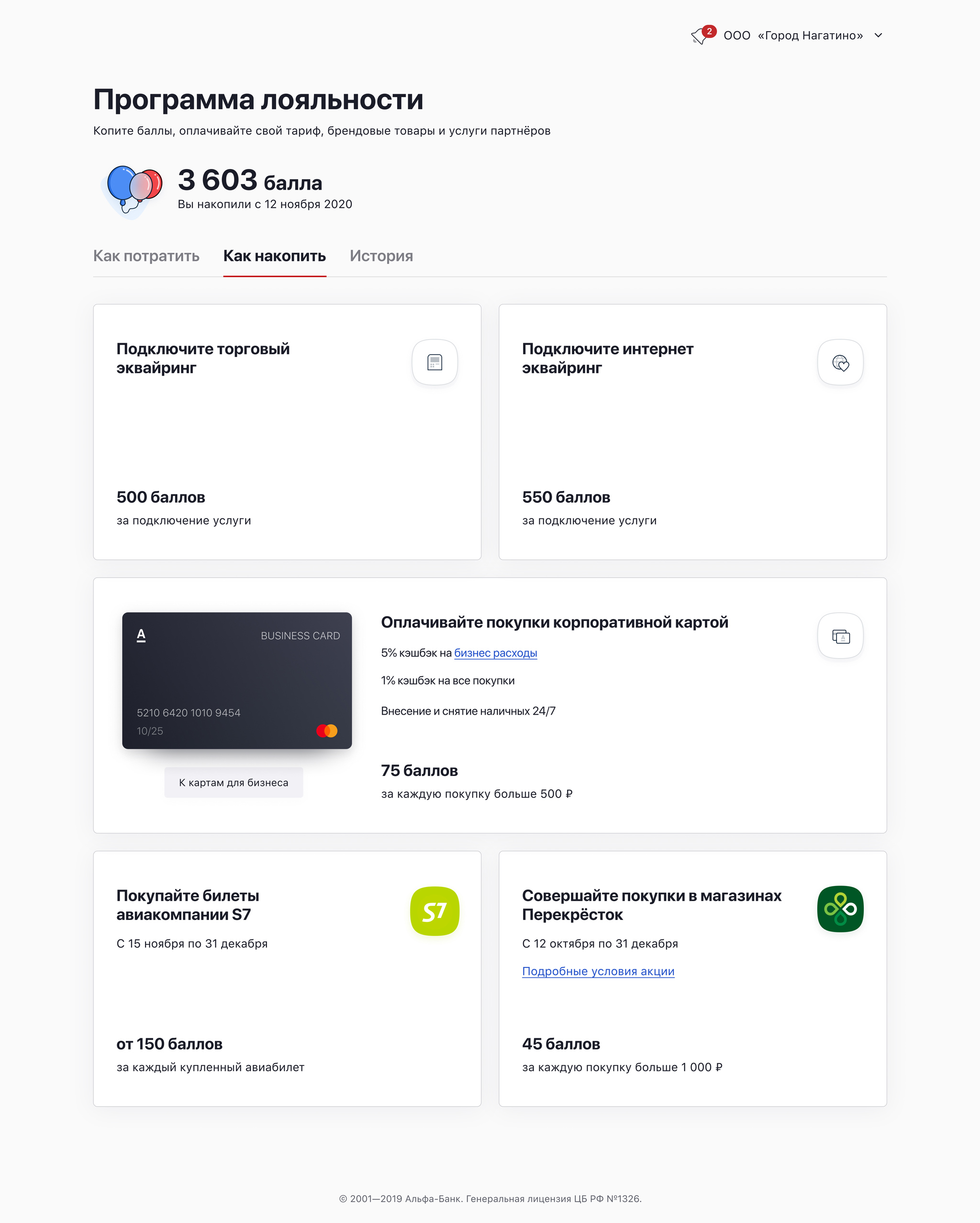

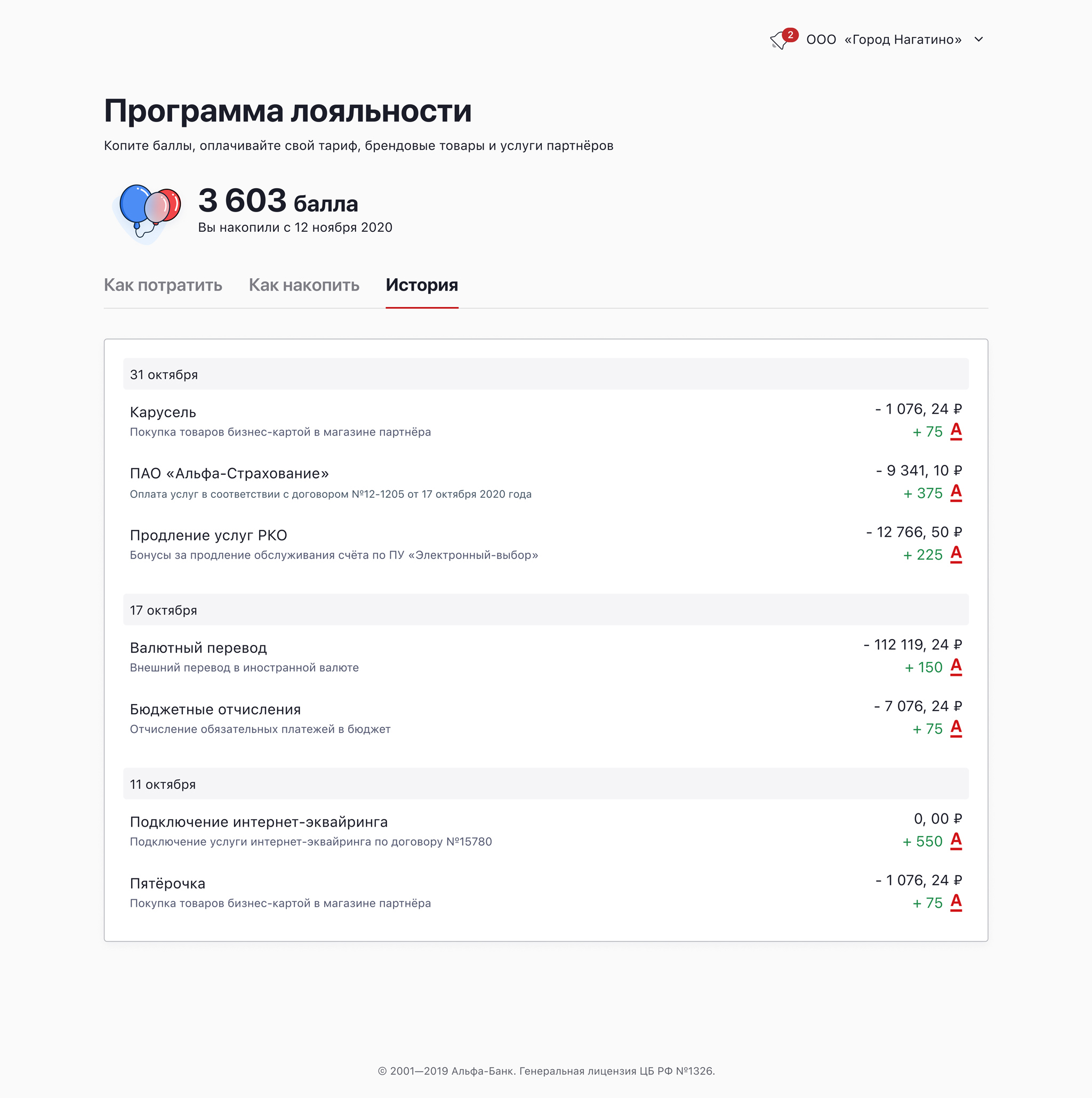

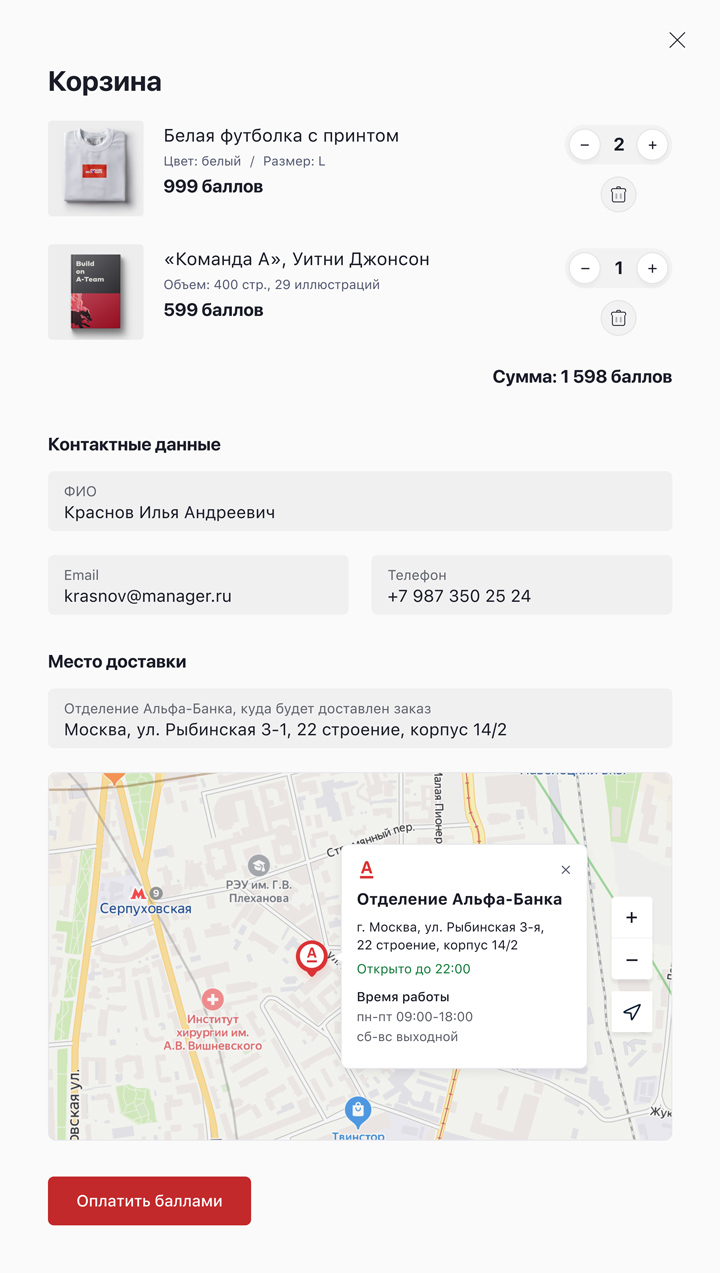

Alfa-Bank had a loyalty program, but clients rarely used it. Initial feedback revealed that users found it difficult to locate their accumulated points and that there were no appealing rewards for which to redeem them. Therefore, it was decided to overhaul this section.

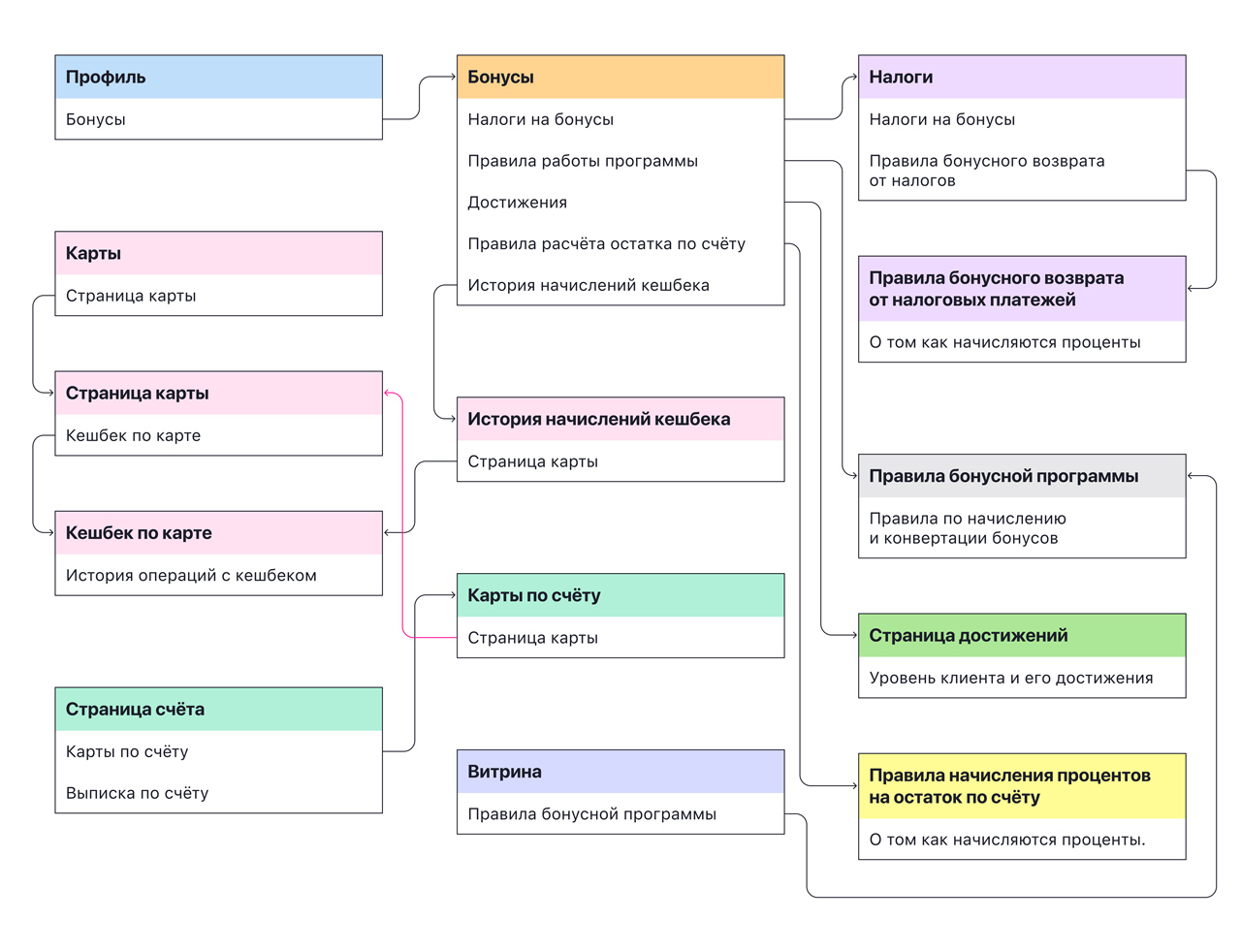

We conducted a workshop and research session with business analysts, product managers, and customers to define the update’s goals. Based on this, I created a map for the new service, designed to seamlessly integrate new features and update existing ones.

The first workshop on the loyalty program update.

The map outlines where elements such as a referral program, bonus points, cashback on cards, and a showcase of reward products will be placed within the online banking architecture. It was crucial to ensure that we communicate available benefits effectively without distracting clients from their main tasks, as they are focused on running their businesses and prefer to avoid unnecessary complexity.

New loyalty program map.

From following discussions with clients, I identified a few key points:

Clarify Text and Names: The updated service’s text and names needed to be considered carefully. Large businesses also have their own loyalty programs for their customers, so we needed to avoid any confusion. To address this, we added the prefix "Alfa" to all our services—e.g., Alfa Points, Alfa Cashback, etc.

Integration of Loyalty Programs: Companies need to manage their own loyalty programs. Benefits from these programs must be included in the tax base, which not everyone wants to do. To simplify this, I included features in the project’s statement and tax pages to automatically calculate the necessary amounts.

The restriction has appeared in the course of work. Initially, I planned to aggregate bonuses across all client organizations. However, since points are tied to individual organizations and changing this would be costly, we adjusted our approach. This limitation was noted in the new information schema I prepared for further discussion.

New loyalty program information map.

Next, we established priorities for testing. We began with the loyalty program’s main page and then tested the prototype, which included the profile, invoice, card, and tax analytics pages.

A few layouts from the prototype.

After reviewing the solutions, we decided to simplify many screens, retaining only the most essential features. Some decisions were also deferred because the teams responsible for accounts and taxes lacked the resources to fully implement our plans at that time.